Summary

I. The Opportunity: 2025 was a paradox. While prices lagged, the structural rails for the "Imminent Upgrade" of global finance were laid down. This disconnect—between price action and fundamental progress—creates a classic mean-reversion opportunity.

II. The Vessel: We spent 2025 building Qapture to target this specific opportunity. We are BMA-registered, institutionally operational, and powered by QORE (our proprietary decision engine). We are ready to capture the upside while actively managing the volatility.

III. The Three Vectors: In 2026, we are focusing on three high-velocity themes where our edge is strongest: Institutional Tokenization, DeFi 2.0, and the AI x Crypto convergence.

The Bottom Line: The horizon is clear. The vessel is ready. Time to raise anchor and set sail.

I. The Opportunity

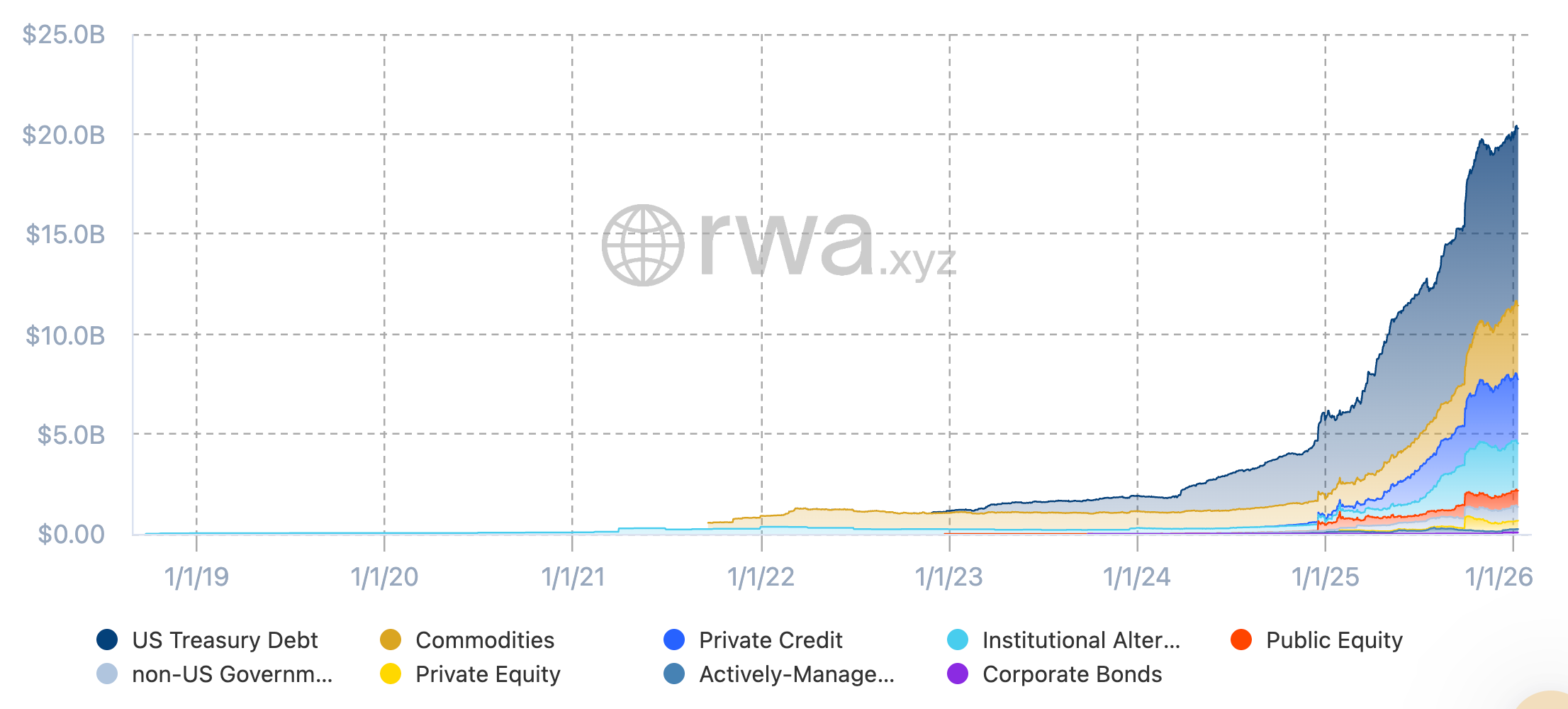

We are witnessing a synchronized global effort to upgrade financial rails. We call this structural evolution The Imminent Upgrade. 2025 saw the tipping point, where tokenization rapidly accelerates, and progress will continue to compound. Markets will catch up to fundamental progress.

The Macro Shift: The "Imminent Upgrade"

We are witnessing a synchronized global effort to upgrade financial rails. We call this structural evolution The Imminent Upgrade. It is not merely a market cycle; it is the secular restructuring of the global financial system. We are witnessing the inevitable migration of global value—equities, bonds, real estate, and currency—onto decentralized, programmable ledgers.

We are moving from a legacy system defined by opacity, banking hours, and fragmentation to one that is transparent, instantaneous, and 24/7.

This is the digitization of value, comparable in scale to the digitization of information in the 1990s. The direction of travel is no longer theoretical—it is set. The only variable remaining is velocity.

The Tipping Point: Buying Power Living On-Chain

2025 marked the turning point where tokenization moved from "pilot" to "production." This shift was led not by niche assets, but by the most fundamental unit of finance: the dollar itself.

Stablecoins have proven their utility as the settlement layer of the internet, becoming essential in regions with unstable fiat and streamlining cross-border payments. This matters because once buying power is positioned on-chain, it typically never goes back. The friction of off-ramping is replaced by the efficiency of on-chain utility.

The Near-Term Focus: "Picks and Shovels"

Our longterm mission is to service clients effectively in a fully on-chain economy. However, the immediate opportunity—and our primary focus—is investing in the "picks and shovels" of this upgrade. We are not just betting on the asset themselves; we are owning the infrastructure layers—the protocols, platforms, and networks—that the entire new system is being rebuilt upon.

The 2025 Paradox

This inevitability creates a stark paradox when looking at the last 12 months. By every structural metric, 2025 was a breakout year:

US Regulatory Reset

- •SEC dropped lawsuits against Binance and Coinbase, restructured its crypto division

- •GENIUS Act passage unleashed stablecoin innovation and adoption

- •Pro-crypto administration signaling 2026 as digital asset policy priority

- •SAB 122 allowing banks to offer crypto custody services

Global Coordination

- •G20 crypto policy implementation roadmap advancing

- •Multiple jurisdictions (Singapore, Dubai, Hong Kong, UAE) establishing clear frameworks

- •Bitcoin-backed municipal bonds (New Hampshire) integrating crypto into public finance

- •Texas holding BTC via ETFs—states leading where federal policy follows

Yet, prices stagnated. While AI stocks, gold, and silver led headlines and delivered strong returns, digital assets lagged significantly. Bitcoin's 2025 performance of -6% pales in comparison to gold's record highs and Nvidia's AI-driven surge. This divergence is not a sign of structural weakness—it was a temporary crowding into other narratives.

The Opportunity

We are not betting on a projection. This is a classic mean reversion setup: capital is still positioned elsewhere while value is being built here. That lag—between infrastructure and price—is the window where smart capital enters.

For institutional investors, the question is no longer "if" but "how." Mainstream adoption is Imminent, and the opportunity to capitalize on it is in full swing. The only remaining question is deployment. How to access this opportunity with the operational rigour, risk management, and compliance frameworks that institutional capital demands. That is precisely what we spent 2025 building. We designed the vessel that captures this opportunity.

II. The Vessel

After four decades in investment management and over a decade pioneering digital asset products, Fred Pye knew the ideal strategy for targeting the Imminent Upgrade and sought to design it.

Fred came up through traditional finance: trading precious metals and foreign exchange, helping grow Fidelity Canada during its formative years, and later founding Argentum to launch Canada's first long-short mutual fund. He ran quantitative strategies before "quant" was a buzzword. Then he turned to digital assets—founding 3iQ and leading the regulatory effort that resulted in the first exchange-listed Bitcoin and Ether funds in North America, and the first regulated diversified digital asset fund in Canada. He helped launch some of the world's earliest crypto ETFs and brought the first Bitcoin fund to the Middle East.

He ran multi-billion dollar single-asset vehicles, quant strategies, and passive products. He's seen what works and what's underperformed (or outright dangerous). And through it all, one approach stood out as the only one agile enough for a market moving this fast:

Active Management.

That conviction is why Qapture exists.

Finding the Right Structure

Investors have options for accessing digital assets. Each has merit—but each also leaves opportunity on the table.

| Characteristic | Single-Asset (BTC) | Passive Index | Systematic/Quant | Active Multi-Strategy |

|---|---|---|---|---|

| Exposure Breadth | Store-of-value only | Broad but backward-looking | Rules-defined | Full opportunity set |

| Emerging Themes | ❌ Misses infrastructure | ❌ Lags by design | ⚠️ If rules permit | ✅ Early rotation |

| Risk Management | Hold through volatility | No mechanism to exit | Automated stops | ✅ Active de-risking |

| Yield Capture | ⚠️ Limited | ❌ None | ⚠️ Limited | ✅ 10-20% when sidelined |

| Regime Adaptability | ⚠️ Single thesis | ❌ Basic rebalancing | ❌ Fragile to liquidity shocks | ✅ Data-driven judgment |

Single-Asset Strategies (BTC-only)

Bitcoin is digital gold—a critical anchor for any portfolio. But a BTC-only approach, while sound, misses the core of the opportunity. The "Imminent Upgrade" is about infrastructure, not just store-of-value. The protocols, platforms, and networks powering the next financial system will capture outsized value in this phase, and investors must prepare for the variety of ways it might unravel.

Passive Indices

Market-cap weighted indices provide broad exposure, but they look backward at what has already worked. They drag in yesterday's winners, can't tilt toward emerging themes, and have no mechanism to step aside when risk/reward deteriorates. In a market where the top 10 assets shift meaningfully every cycle, passive indexing leaves alpha on the table.

Systematic / Quant-Only Strategies

Rules-based systems work well in efficient markets with deep liquidity. Digital assets are neither. Markets are reflexive, narrative-driven, and prone to flash crashes that break the infrastructure systematic strategies depend on. October 10th was a case study: a tariff headline triggered $19B in liquidations, Binance's internal oracle mispriced collateral, and liquidity evaporated in minutes. Automated systems that relied on stable order books and pricing infrastructure were caught flat-footed. Human judgment—informed by on-chain data, protocol-level research, and market structure awareness—remains essential.

The Answer: Active Multi-Strategy

What's needed is a structure agile enough to capture the full opportunity—one that can rotate into emerging themes before they're crowded, step aside when risk/reward deteriorates, and put capital to work even when sitting in cash. That's what active multi-strategy management provides.

What We Target

Our actively-managed meta-model moves between two strategies:

Directional Focus

When risk/reward favours being directional, we deploy disciplined, factor-weighted exposure across strong narratives. This is not passive indexing; it's active allocation informed by research and optimized with risk-managed yield.

Stable Yield

When risk/reward deteriorates, capital rotates into risk-managed, yield-bearing stablecoin strategies generating 10-20% annualized with minimal directional exposure. This provides us with high-opportunity cost for being in-market, allowing us to deploy directionally with high-conviction only.

How We're Built

Institutional allocators need more than a thesis; they need a vessel capable of navigating choppy waters. We didn't just build for a bull market—we built for reality.

1. Infrastructure First

Fred Pye founded Qapture to build on a legacy of managing regulated digital asset strategies. After leading the first regulated major exchange-listed crypto fund listings in North America, we knew that scale requires a foundation of safety. We spent 2025 engineering the infrastructure to service institutional clients:

- •BMA Registered: The Qapture Digital Asset Fund (QDAF) is registered with the Bermuda Monetary Authority, allowing us to relaunch and evolve a seven-year track record portfolio in a leading digital asset jurisdiction.

- •Next-Gen Security: Custody is managed through Copper, utilizing CopperClearloop to mitigate counterparty risk from trading venues.

- •Top-Tier Admin: We have onboarded with Apex Group for fund administration and a comprehensive investor relations suite.

- •Liquidity: We designed our product to be liquid, so that institutions can flexibly position this within their portfolios.

2. Market Intelligence & Decision Systems

We deployed QORE (Qapture Operating and Research Engine), our proprietary system for agentic decision-making. It is designed to standardize investment workflows by automating data streams across research, execution, and risk management. It is engineered to process market and portfolio intelligence and assist execution. The system identified:

- •August ATH breakdown (Regime Shift + Risk-Off signals = full structural breakdown)

- •October 10th stress (Regime Shift only = elevated stress, not systemic)

- •Flash Crash Alerts hours before both August and October collapses

QORE translates noise into weighted vectors, powering our Investment Committee to make informed decisions with full-context knowledge.

3. Active Yield Optimization

We are not just holding tokens; we are putting them to work in risk-managed ways.

- •Staking yields on ETH, SOL, and other assets on top of price appreciation.

- •Stablecoin yield: creating strong returns when sitting in cash.

- •DeFi Positioning: Accessing on-chain strategies that passive indices simply cannot touch.

4. Team Expansion

Strategic hires across trading, research, and engineering enable:

- •24/7 market monitoring and execution

- •Quantitative strategy development

- •Real-time portfolio analytics and risk management

- •Expanded research coverage across macro, digital asset macro, and micro analysis

The Commitment

We built Qapture as investors for investors. Under Fred's leadership, we designed QDAF as the optimal vehicle to manage the family office's liquid digital asset exposure for decades to come—and built it to onboard partners who want institutional-grade execution in a constantly evolving market. Our conviction isn't theoretical. It's informed.

With the vessel built, 2026 is the year we go live and expand—deploying this platform across three narratives that we believe will define the next phase of the market.

III. The Narratives

With the vessel built, 2026 is the year to capture the opportunity. Adoption is moving from pilots to deployment, and capital is starting to follow the infrastructure. That opportunity expresses itself across three narratives, with tokenization as the end game. Stablecoins proved that once settlement and buying power are on-chain, broader value follows.

The catalyst is institutional. Firms are no longer observing—they are deploying, pulling the ecosystem toward privacy, distribution, interoperability—and the next leg of the Imminent Upgrade.

1) Institutional Readiness: Privacy, Distribution, and Interoperability

Institutions cannot always deploy meaningful size on fully transparent, retail-native rails. For tokenization to go from "issued" to usable, the stack has to support three requirements:

- •Privacy-preserving execution: Confidential transactions with selective disclosure, so positions and flows are not broadcast to the market.

- •Distribution-ready rails: Identity, compliance, and access controls embedded into the workflows so regulated participants can onboard and transact.

- •Interoperability: Integration with existing capital markets plumbing (custody, messaging, settlement, reporting), so tokenized assets can plug into real portfolios.

⇒ Qapture's Edge

We are deploying into ecosystems that institutional tokenization requires—because once distribution and interoperability are in place, adoption compounds quickly.

2) DeFi 2.0: Institutional Yield + On-Chain Market Structure

The Opportunity

DeFi is maturing from "wild west" experiments to institutional-grade protocols. With stablecoins overtaking legacy payment rails, the infrastructure for global finance is now transitioning on-chain.

DeFi 2.0 is also where tokenization becomes functional: tokenized Treasuries and credit products can be used for yield, collateral, and treasury management. Platforms such as Maple lead the early wave of private credit moving on-chain.

⇒ Qapture's Edge

Our active strategy captures alpha that passive funds miss.

- •Risk-managed Yield: Staking, lending, and liquidity provision on blue-chip protocols.

- •Market structure primitives: DEXs, lending, swaps, and prediction markets.

- •Risk management: Active position sizing and diversification that passive indices cannot provide.

3) AI x Blockchain: The Agent Economy

The Opportunity

Decentralized AI is emerging as the critical counterweight to centralized hyperscalers. The "Agent Economy" requires rails for payments, coordination, and verification—and blockchain provides the native infrastructure layer.

⇒ Qapture's Edge

We identified this convergence early.

- •High conviction: Early and active allocation to decentralized compute networks and infrastructure (TAO, Render).

- •Narrative tracking: Research edge identifying shifts in the AI/Crypto intersection before they become consensus.

Bottom Line

We believe 2026 will be the year the "Imminent Upgrade" becomes visible to the mainstream. But we aren't waiting for the world to catch up. We specialized in building a modernized engine for the right approach. We are ready now. We have a long journey ahead.

The horizon is clear. It is time to raise anchor and set sail.